With the demise of guaranteed pensions, and in light of the risks you face in managing your own retirement assets, maximizing Social Security becomes a critical part of retirement planning.

HOW CLAIMING AGE AFFECTS THE INCOME STREAM

One of the most important decisions a retiree faces is when to apply for Social Security benefits. This is not a decision to be made lightly; the lifetime, inflation adjusted income promised by Social Security makes it one of a retiree’s most significant assets.

If you were to calculate the present value of the Social Security income stream, it would rival or exceed the lump sum many people have in their 401(k) plans at retirement. Serious investors work hard to maximize the value of their IRAs and 401(k) plans, often not realizing that their Social Security “asset” can be maximized as well. Pre-retirees can enhance its value by building a strong earnings record and applying for benefits at the optimal time.

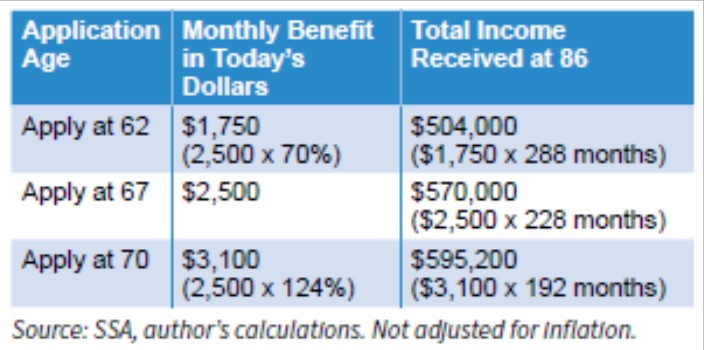

Let’s say you have a primary insurance amount (PIA) of $2,500. This is the amount of monthly income you will receive if you apply for Social Security at your full retirement age. Full retirement age is 66 for baby boomers born between 1943 and 1954, gradually increasing to 67 for those born later. Let’s also say you have a life expectancy of 86. This is slightly longer than the average life expectancy, but there’s a good chance you or your surviving spouse will live at least that long.

If you apply for Social Security at 62, your benefit will be reduced to account for those five extra years of checks. If your PIA is $2,500, your permanent benefit would be $1,750, which is 70% of $2,500. If you apply for benefits at 70, your benefit will get a boost of three years of 8% annual delayed credits, giving you a permanent benefit of $3,100 a month.

Now let’s see what the lifetime value of your Social Security income stream would be depending on when you start your benefit.

Source: SSA, author’s calculations. Not adjusted for inflation.

The key to maximizing your Social Security “asset” is to understand the lifetime value of the income stream. If you are looking at your Social Security statement, you may be tempted to take $1,750 per month at 62 rather than waiting until age 70 to receive $3,100 per month.

But if you consider the lifetime value of your benefits, assuming a realistic life expectancy, you can see that claiming the higher benefit at 70 will give you more total benefits over your lifetime. Just as you seek

to maximize the value of your IRA and 401(k), you can also maximize the value of your Social Security. You can do this by locking in your highest benefit by claiming it at age 70.

SPOUSAL AND SURVIVOR BENEFITS

When the combined benefits for a married couple are taken into consideration, the analysis becomes more complex. You must take into account each spouse’s age, their combined life expectancies, the benefit based on each spouse’s own earnings record, the spousal benefit for each spouse, and the amount the surviving spouse would receive after one spouse dies.

If the higher earning spouse dies first, the lower earning spouse will jump up to that higher benefit. If the higher earning spouse had maximized his benefit by claiming it at 70, this will give the widow more income. This is why we nearly always recommend that the higher earning spouse claim his benefit at 70. This will maximize his retirement benefit while he is alive and the survivor benefit for the widow after his death.

But everyone’s situation is different. That’s why it is important to get a customized analysis of your claiming options and to understand both your potential monthly income as well as the amount of Social Security you stand to receive over your lifetime based on your claiming age.

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Fee based financial planning and advisory services offered by Genesis Wealth Management Group, LLC, an Independent Registered Investment Advisor.

Elaine Floyd, CFP®, is the Director of Retirement and Life Planning, Horsesmouth, LLC., where she helps people understand the practical and technical aspects of retirement income planning.

Copyright © 2022 by Horsesmouth, LLC. All rights reserved.

This reprint is provided exclusively for use by the licensee, including for client education, and is subject to applicable copyright laws. Unauthorized use, reproduction or distribution of this material is a violation of federal law and punishable by civil and criminal penalty. This material is furnished “as is” without warranty of any kind. Its accuracy and completeness is not guaranteed and all warranties expressed or implied are hereby excluded.